Consumers are spending more time watching video on televisions connected to the internet, giving advertisers more opportunities to reach them through ad-supported streaming services. The convergence between linear television and digital video is culminating in connected TV (CTV).

“What’s interesting about CTV specifically is if you look at the mechanism by which users get their content, it’s about as close to digital and online video as you can get,” Moe Chughtai, global head of advanced TV at ad-tech firm MiQ, said in this interview with Rob Williams, senior editor for Beet.TV.

“Your TV today is basically a computer screen,” Chughtai said. “Advertisers can deliver content to individual users instead of at reach. Buying mechanisms — we found over the last five years — are almost identical to buying mechanisms for online videos.”

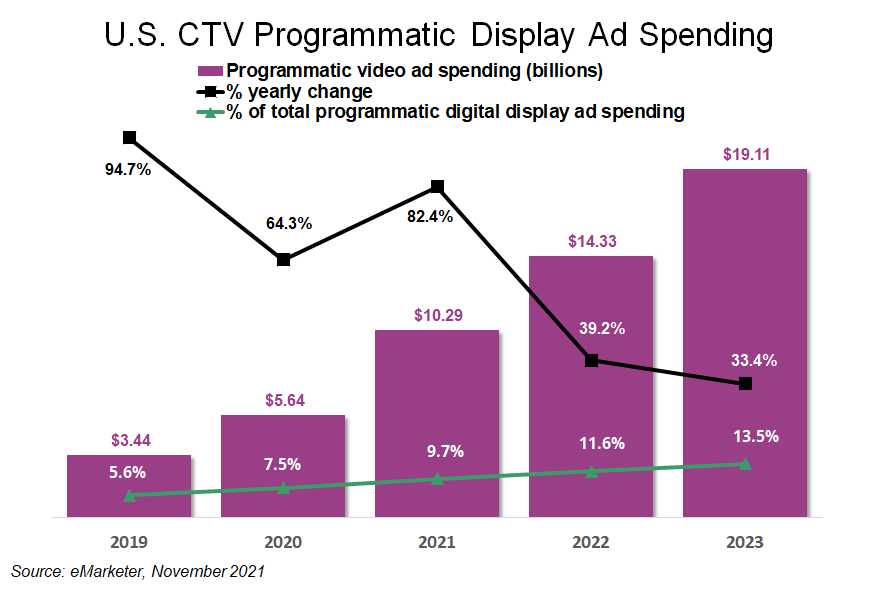

The growth in streaming services with advertising (including platforms that plan to start selling ad insertions, such as Netflix and Disney+) will open up more CTV ad inventory to automated auctions. Programmatic ad spending on CTV will grow 39% this year to $14.3 billion in the United States, researcher eMarketer estimated.

In speaking to marketers, Chughtai said they were looking for technologies in CTV that were similar to those in digital display and video advertising: “How do I do planning across screens? How do I identify my audience, and reach them no matter where they’re going? How do I measure to metrics and business outcomes that matter, not just completion rates or reach and frequency?” he said. “That’s where MiQ really started in the CTV space.”

Ad-Tech and Measurement Partners

Advertisers can find ways to reach streaming viewers, whether they’re spending time in walled-garden environments like YouTube, Roku and Amazon or the open web, Chughtai said. MiQ collaborates with partners such as Samba TV to gain insights into viewer behavior. Automatic content recognition (ACR) technology can track what appears on viewer screens, regardless of its source.

“Whether someone is watching linear programming or watching OTT [over-the-top], gaming, YouTube…MiQ consumes that content, and uses that to create planning, buying, measurement, capabilities for marketers,” Chughtai said.

Global Footprint

MiQ operates in the United States and Canada, Australia and Europe, giving the company insights that can be applied among a variety of markets.

“Marketers are relying on us to abstract away the complexity and sort of build international campaigns,” Chughtai said. “When a brand comes to us and wants to run across, six different markets, it’s going to make you to figure out the complexities of those markets as media partner for them.”

Total Video Future

Whether viewers watch linear programming or streaming, the goal is to provide them with a seamless experience that provides advertisers with a brand-safe environment to convey their sales message.

“We really see a total video future — not a TV future, online video or CTV future,” Chughtai said. “We’re developing capabilities that allow us to support audiences across different ecosystems.”