The upfront advertising sales season this year comes amid the continued disruptions of the pandemic to people’s viewing habits and shopping behaviors. The crisis also has led to concerns about the availability of quality programming as the health crisis creates turmoil for studios and producers.

“This year’s upfront is going to look different than it has in the past,” Brad Feinberg, North America vice president of media and consumer engagement at brewing giant Molson Coors, said in this interview with Beet.TV. ” There are external factors at play: whether the content is available. The upfront is as much about the content presentation as it is about how brands are spending their dollars.”

He said he wants to hear more about how TV networks plan to program their linear channels and their digital streaming platforms. With more people consuming video on connected devices like smart TVs and mobile phones, those digital platforms have become more significant for marketers.

Feinberg sees advantages in securing media placements during the upfront sales season, especially for inventory that’s in high demand. He also is looking for flexibility amid the uncertain outlook.

“We will make those commitments where … we want to make sure we have a presence,” he said. “Other than that, we will look for flexibility and we’ll place dollars at the threshold we feel is appropriate and available to meet our minimum needs. We will make changes and shifts across the course of the year, as change in consumer behavior can be unpredictable.”

First-Party Data

When it comes to allocating media dollars to connected TV and programmatic platforms, the top concern is ensuring that inventory is available to buy through automated auctions, he said. Another key concern is transparency to ensure that data-driven media buys are effective at reaching target audiences.

“We are implementing first-party data solutions where we can — really ramping up our ability to have a view of consumers that have ‘raised their hand,’ that want to know about our brand,” Feinberg said. “Those are more of your loyal consumer bases.”

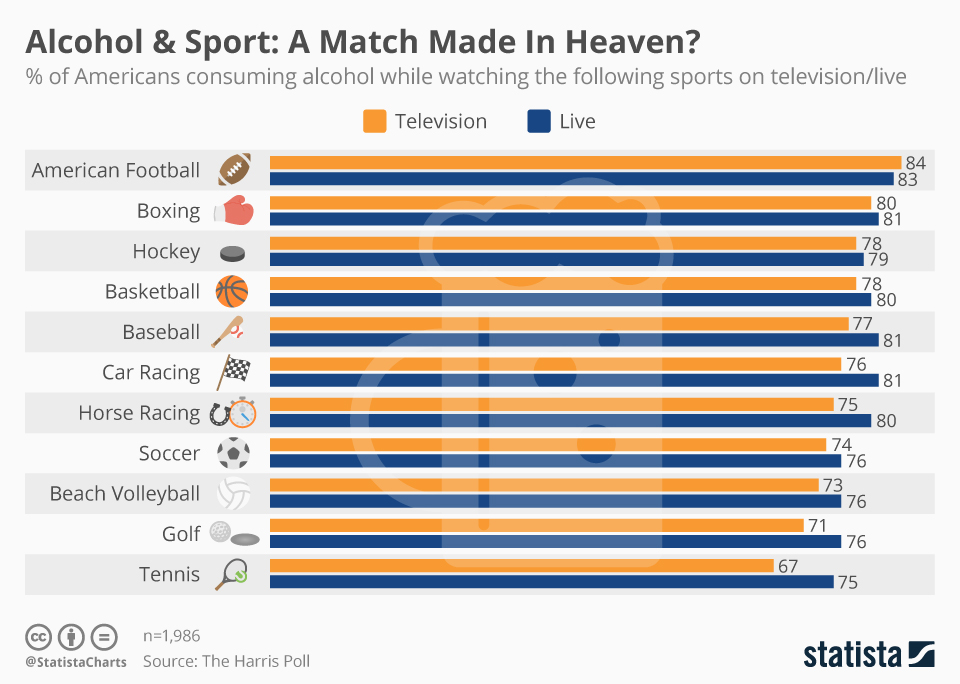

Reaching sports fans is especially important for makers of alcoholic beverages, with at least one survey showing a strong correlation between alcohol consumption and viewing sports. The sports calendar this year is showing signs of getting back to normal after the pandemic led many professional and college leagues to cancel or delay their seasons in 2020.

Source: The Harris Poll, Statista

“I consider it [sports] the competitive battleground of the alcohol beverage category. There are some pretty big players in our space that are all competing for the same eyeballs, and we know our products are enjoyed responsibly while they’re watching live sports,” Feinberg said.

Miller Coors also is looking for ways to engage sports fans who watch games while also participating in social media conversations on their smartphones.

“We want to make sure our brands are showing up in a way that can create engagement — like “the game around the game” concept where it makes sense,” he said.

You are watching “Optimizing a Rapidly Converging TV & Video Marketplace: What’s Next,” a Beet.TV leadership series presented by Amobee. For more videos, please visit this page.