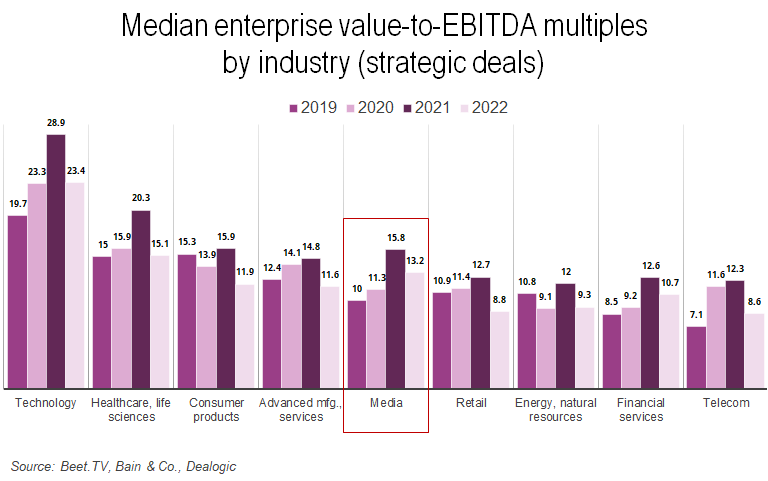

MARCO ISLAND, Fla. – The Federal Reserve’s steps to combat inflation by raising borrowing costs had wide-ranging effects on asset values, including everything from stocks to cryptocurrencies. Falling valuations last year dampened mergers and acquisition activity for a variety industries including telecom, media and technology.

Bankers are hoping to see more signs of recovery going into 2023, even as hostilities such as the war in Ukraine cloud the geopolitical picture.

“There are still uncertainties as it relates to macro, but it feels like we have a handle on where things are going,” Terence Kawaja, founder and chief executive of LUMA Partners, said in this interview with Beet.TV contributor Mike Shields at the IAB Annual Leadership Meeting.

“We reached peak inflation six months ago; people are anticipating that we either will have a mild recession or maybe a soft landing,” Kawaja said. “Some of the fear of the unknowns around the macro stuff has settled a little bit. We still have a war going on.”

Deals in CTV, Commerce Media

Many businesses that were hoping to be acquired for a premium valuation have had to reset their expectations. They can ride out the slowdown until better times ahead, or may face the possibility of selling out of desperation.

But deals can still get done, especially in commerce media and connected television, Kawaja said.

“I don’t think 2023 is going be a bonanza year for deals, but there are areas – “green-shoot” areas, we call them — in CTV and commerce media that are logical for strategics to pick up capabilities,” Kawaja said. “That’s almost unaffected by the sell-off because companies that are doing something unique where there’s scarcity.”

You’re watching ‘What’s Next: Scaling CTV Through Industry Collaboration,’ a Beet.TV Leadership Series produced at IAB ALM 2023, presented by Index Exchange. For more videos from this series, please visit this page.