A couple of years ago, it was a game played by Amazon and a couple of the very biggest retailers.

Now retail media networks have become so big they are also getting complicated.

In this video interview with Beet.TV, Greg Stevens, GM at GIG Retail, a specialist focused on merchant media, explains what needs to happen.

Merchant media are expanding

Stevens’ GIG Retail offers strategy, media planning and sales, insight, campaign management, product marketing, creative solutions and more, with a goal to “drive brand and retailer sales by creating, delivering and evaluating customer-focused campaigns, both in-store and online, across a host of retail-focused marketing and sales activity”.

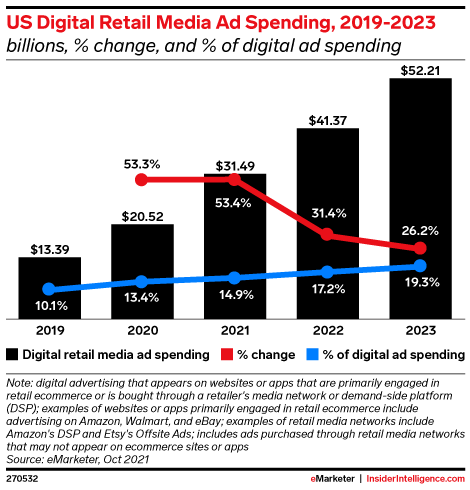

EMarketer says 2022 will be “the year of retail media networks“, with US spending growing another $10bn to $41.37bn, representing 17.2% of total US digital ad spending.

Stevens says: “What once was a few retailers offering retail media in a few channels by a few technology suppliers has really mushroomed into retail media being supported by all retail categories, by lots of retailers in those categories.

“More channels have activated, ranging from sponsored search on site display, but now increasingly in-store display, in-store radio, as well as digital out-of-home near the store.”

Simplify the system

Whilst that all sounds great for both retailers and the brands that see an opportunity to reach consumers in a buying mind state, Stevens says it amounts to added complexity.

“It’s frequent that a retailer will have eight or nine, even 10 different ways to work with them to buy their retail media,” he warns. “They can’t often buy it holistically.

“That creates complications for the supplier and complication often means cost. It also complicates the reporting on the back end – to get a consolidated report is difficult.”

What’s the solution? Simplicity, Stevens says. That includes consolidating entry points and reporting outputs

“The easiest person to work with will get a disproportionate share of dollars,” he suggests.

Changing the definition

Stevens says retail media is taking spend from a broad range of categories – trade buyers, organic digital marketing growth and channel shift from traditional media.

But he says certain digital retailers actually need to keep pace with brick-and-mortar categories.

“The definition needs to include in-store display in-store radio digital out of home, near the store, the parking lot, the recharging stations in the parking lot,” he says.

You are watching “The Road to Cannes 2022 – Commerce: The New Cannes Conversation”, a Beet.TV Preview Series presented by Criteo. For more videos from this series, please visit this page.