Once upon a time, they would have been merely ad buyers. Now retailers are also becoming media networks themselves.

But who is spending for ads through the likes of Target, Walmart and Boots, and what does the future hold?

In this video interview with Beet.TV, Elizabeth Marsten, Senior Director, Strategic Marketplace Services, Tinuiti, explains what she is seeing.

Retail rocket ship

Retail media networks are springing up because digital retailers have realized they hold volumes of first-party consumer data which can be used to target ads for companies with marketplace or wholesale products to sell.

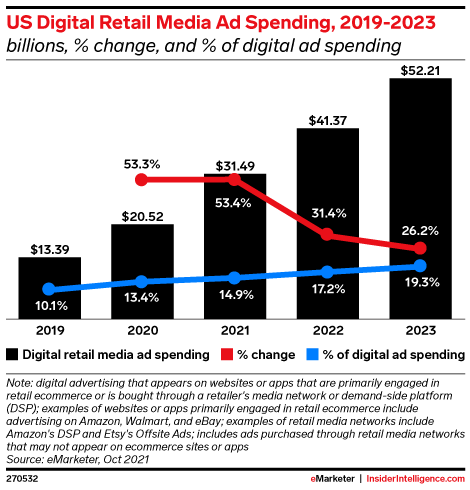

EMarketer says 2022 will be “the year of retail media networks“, with US spending growing another $10bn to $41.37bn, representing 17.2% of total US digital ad spending.

Tinuiti is a performance digital marketing agency.

Tinuiti’s Marsten has been rolling out services for buying ads in Walmart and Instacart, with Kroger, Home Depot (PromoteIQ), Target Roundel, Shipt (Criteo) to follow.

She says: “The pandemic spurred that – we had a lot more eyeballs online than we did, say, physically on a shelf. So a brand can then enable and act, decide how it is they want to show up digitally and physically.”

This is a thing. And with some kick ass presenters. THIS THURSDAY. https://t.co/9mcmwz2oGb pic.twitter.com/HUjIssN21n

— Elizabeth Marsten (@ebkendo) May 16, 2022

Build versus buy

To a large extent, the trend was kicked off by Amazon, which sold $3.1 billion in advertising last year. But now other ecommerce sellers are getting in on the act – but that comes with software challenges.

“A Walmart and an Instacart have built their own … tech stack,” Marsten says. “Target, not as much. They partner with some of the sell-side platforms, like a Criteo. Same with some of those smaller retailers – it’s not feasible to build their own tech stack.

“That is a huge undertaking to build the infrastructure, to have a retail media network. That is where a sell-side platform or that tech can come in handy.”

Spend migration

Marsten says retail media networks often have a range of ad units and customer data to use. She says she is seeing ad spending on this category take off.

“It’s going up and it’s going to the right,” she says. “And the question has been, ‘Where’s the budget coming from? Whose budget is that the right place where that budget should be coming from?’

“A lot of shopper trade dollars came in, I’m even starting to see some search (spend migration). Some of the more classic locations, you know, with Facebook, deprecation of tracking with an apple, some of the money is going to move from there.”

You are watching “The Road to Cannes 2022 – Commerce: The New Cannes Conversation”, a Beet.TV Preview Series presented by Criteo. For more videos from this series, please visit this page.