With a new Creative Commerce award track at Cannes Lions 2022, it is clear that, this year, the fusion of ecommerce and media is closer than ever.

But, as more retailers become media networks, how is the opportunity set to shape up?

In this video interview with Beet.TV, Todd Bowman, VP Services, Momentum Commerce, an advisory firm for brands, explains.

Expanding opportunity

Bowman notes how Amazon sponsored ads, Amazon DSP, Walmart Connect, Target’s Roundel and Criteo have already been a boon for retailers.

Now, he says, tech from the likes of PromoteIQ, CitrusAd and Instacart is also amplifying that opportunity.

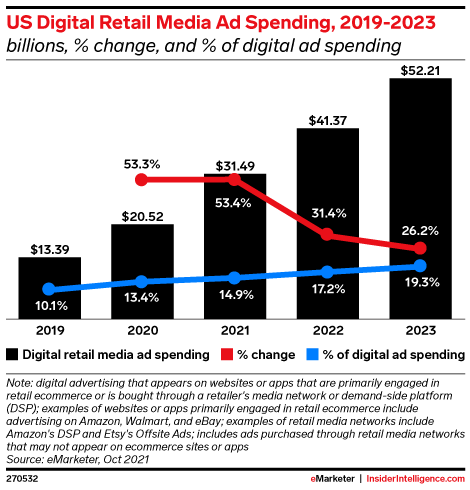

EMarketer says 2022 will be “the year of retail media networks“, with US spending growing another $10bn to $41.37bn, representing 17.2% of total US digital ad spending.

Data moves the needle

The big benefit of advertising with a retailer media network, Bowman says, is being able to target their first-party customers.

“They know their customers, they can help you find them and be more effective with your ads,” he says.

“But also we’re getting more data. There’s more ability for us to see total addressable market at Momentum Commerce.

“We have data coming in so we can understand how brands are performing to their category. Are they taking share, are they losing share, how are they growing?

“We’re looking at the market in addition to really focusing on their day to day advertising programmes as well.”

Brands re-integrate capability

As the retail media network opportunity has expanded, many brands have responded by splintering themselves, Bowman suggests

“A lot of CPGs have kept their brand advertising separate from their ecom advertising,” he says. “Even in an ecom perspective, they were very siloed – you had an Amazon team, a Walmart team, a Target team. What they’re finding is, there’s a lot of duplication happening within their teams.

“A lot of these CPGs are finding what they need to do is bring those teams together. When they come together, they’re able to build a broader front and build leverage to those retailers to help take a little bit more control of what’s happening.

“Now the brands are finding ways to gain their own leverage, to help push the retailer, to provide more and better ads and better reporting capabilities.”

Smaller firms, from ‘buy’ to ‘build’

The next wave in this wide will be spreading the opportunity to smaller retailers, Bowman says.

“Smaller retailers want to get into to the media business,” he says. “It is a profitable capability for them to offer platforms like Criteo, Citrus Ad, PromoteIQ have a platform in the algorithm that they can launch onto the site for each of these retailers.

“These partners can come in and help them build a basic sponsored ads capability that allows brands to have a CPC keyword focused media programme to help promote their products.

“As they progress, then they need to build their own tools (to) … take advantage of the first party customer data that they have and building out more of a display platform.”

You are watching “The Road to Cannes 2022 – Commerce: The New Cannes Conversation”, a Beet.TV Preview Series presented by Criteo. For more videos from this series, please visit this page.