Consumers are watching video content on a broader range of devices including smartphones, making multi-screen measurement an essential part of the growth in video advertising. The shift in video consumption habits will underpin a move away from traditional methods of measuring viewership and toward metrics that include more media channels.

“We need to move away from transacting on GRPs, and we need to transact on an impression-based model,” James Rooke, general manager of Effectv, the advertising sales division of Comcast Cable, referring to “gross ratings points” that quantify impressions as a percentage of a target population. “It’s 2020, and the fact we’ve not grown a lot on this journey is problematic.”

In this second episode of series co-produced by Beet.TV and video advertising trade group VAB, Rooke shared his thoughts about recent trends with Sean Cunningham, the president and CEO of VAB.

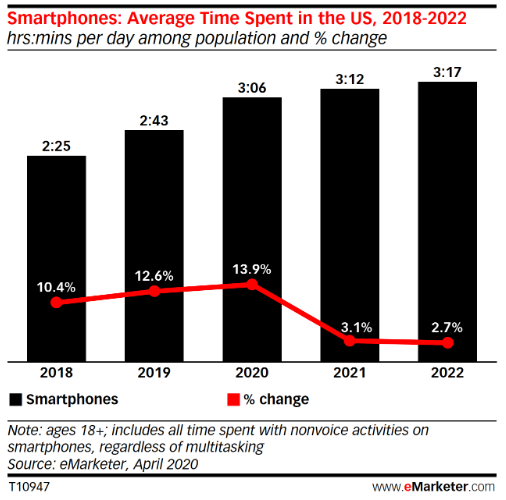

Rooke sees a need for impression-based measurement amid the shift toward multi-screen video consumption. U.S. consumers are forecast to increase their time spent on mobile devices to more than three hours a day this year, up from about two and a half hours in 2018, according to researcher eMarketer. Smartphones give advertisers a way to reach younger consumers who watch their favorite programming throughout the day.

Advertisers and media channels recognize the need for impression-based advertising amid the shift toward a multi-screen, audience-based and addressable world, Rooke said.

“The question is: how do we use this moment now to accelerate it becoming the norm? We need to overcome a series of challenges, including legacy mindsets, incentive structures and system constraints, among others,” he said. “If we don’t do this, then innovation in the television industry is going to be held back — and the only one’s that’s going to gain from that are going to be the tech platforms.”

Lifting DTC Brands

Video channels need to highlight how commercials drive return on investment (ROI) and results at all stages of the purchase funnel, Rooke said. “Last-touch attribution” that gives greater weight to digital ads to convert viewers into buyers devalues the power of television to help drive business outcomes.

“The truth’s on our side here — we just haven’t done a good job as an industry proving it,” Rooke said. “We’re not where we need to be in terms of proof of performance just being de facto, and it should be. When that happens, we’re going to see a shift of dollars away from bottom-of-funnel players as the reality of top to mid-funnel comes to fruition.”

TV and digital are most effective when they work together, Rooke said. He cited internal research that found that when ads air on TV and digital channels, brand recall is twice as high than on digital alone and brand intent is 50% higher. Combining TV and digital are highly effective for direct-to-consumer (DTC) brands that don’t sell products through traditional brick-and-mortar stores.

“There comes a point where their social channels simply can’t provide the reach they need, and they run into issues with excess frequency,” Rooke said. “Multi-screen television has played an absolutely crucial role in helping them scale and go mass market.”