US digital ad spend will slow from a previously-projected 17% growth this year to just 1.7%, as brands tighten their purse strings amid the COVID-19 pandemic, according to eMarketer.

But some executives think bold spending at a time when rivals are cutting back could help some brands emerge out of this period in the lead.

“Right now, what is really, really necessary is to understand how your competitors are approaching the same challenge, how they’re executing in linear, so that you can make better decisions about what you’re going to do,” says Kelly Metz, VP Product Marketing at VideoAmp.

“Everyone in this industry knows that those who advertise in downturns come out of the downturn in a much better place with much higher market share.”

Optimize investment

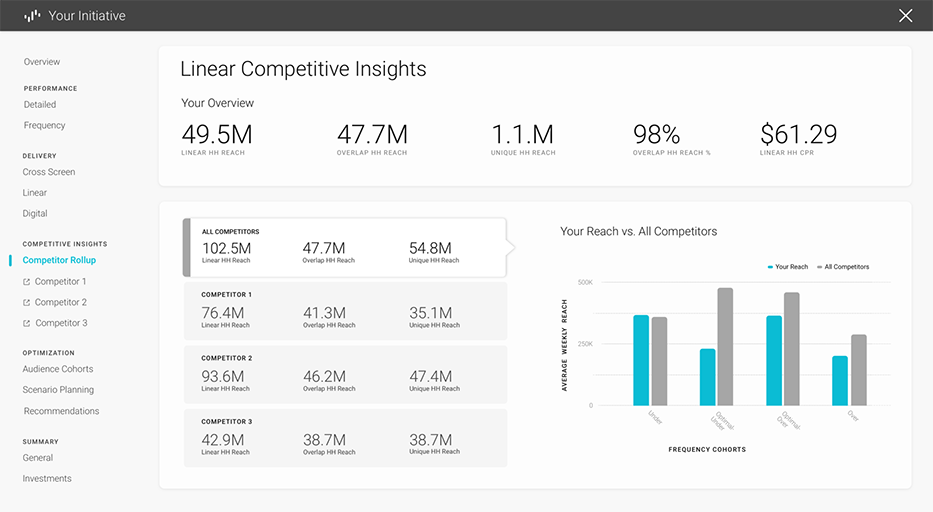

That is why VideoAmp just launched Competitive Insights, a platform which lets ad buyers see the effectiveness of their own TV ad spend, as well as that of their rivals.

In Competitive Insights, ad buyers can see the household reach and frequency of linear TV ads by target audience, plotted against selected competitors. They can compare their spend against rivals and use those insights to further optimize their linear TV investment.

For Metz, understanding your share of voice, and acting on it, is about getting smarter.

“In the time of COVID … you’ve got your advertisers sitting on the fence… do they buy? Do they not buy?,” she says.

“So I think now, more than ever, you inside the agency need to be using this type of data to advise your clients when to be in market and when to be out of market. You need to understand what’s happening vis-a-vis the entire competitive set.”

Linear smarts

VideoAmp’s offer is one way in which software and data these days is bringing smarts to even linear TV ad buying and measurement.

Metz hopes the system will include digital ad buying. But that’s a “future goal”. For now, it leverages set-top box and other TV viewing data that VideoAmp says it “commingles”. That includes linear TV datasets plus spot schedule and spend data from Kantar.

Such tools can help ad buyers understand details including audience by show, day part and network.

“Instead of women (aged) 18 to 49, they are able to actually understand women who own dogs, as an example, and target them very specifically and understand how their campaign’s performing specifically against that target,” Metz says.

Finding spend

If such efforts can increase effectiveness, they may encourage sustained spending in the marketplace. After all, linear ad channels are reckoned to fare worse than digital channels through the pandemic.

EMarketer forecasts buyers’ new reluctant and lack of long-term planning ability will wipe 27% of the this year’s US TV ad sales upfront season, some $5.5 billion.

“In H2, brands will cut a significant share of TV upfront ad spending due to difficult economic conditions,” according to the company.

“Without clarity into whether business operations will be stable later in the year, brands are planning less of their TV buying in advance, which normally gives advertisers about half a year to plan a campaign, and will likely rely on inventory purchased within much shorter time horizons (scatter and digital).”