The audiences for ad-free streaming services like Netflix and Disney+ have coincided with significant investments in content. That programming includes scripted shows that generate buzz and win awards, but are expensive to produce.

“We continue to think that viewing of professional video is going to roughly relate to spending on content,” Brian Wieser, global president of business intelligence at GroupM, a media buying unit of WPP, said in this interview with Beet.TV. “It’s a really accurate model to think about the share of spending that a given entity has on content relative to others and their share of viewing.”

As an example, he cited Netflix as a company that generates 7% of U.S. viewership activity, which is in line with its 7% share of the total amount that media outlets spend on video content. By the same reasoning, audiences are likely to shift their viewing habits as media companies re-allocate their content spending.

“That’s really the driver here. When a network owner and a streaming services owner says, ‘we’re going to shift $2 billion of spending from our traditional linear network into our streaming service,’ you should reasonably expect that the eyeballs will follow the money,” Wieser said. “If there’s more, better content, people will watch it. They will, in fact, pay for it.”

Tolerance For Advertising

As more consumers watch programming streaming platforms with fewer or no commercial breaks, their tolerance for advertising is changing. Marketers and media outlets need to consider these shifts as they compete for consumer attention.

Streaming “environments are unlikely to have anything like the advertising experiences or in terms of the volume of ads that we see in traditional linear TV,” Wieser said. “That really has a lot of implications for marketers who historically relied on the reach and frequency capacity of television to satisfy a given goal.”

Consumer studies have shown that people will tolerate and even enjoy commercials – as in the case of the Super Bowl, when ads match or even exceed the football game in capturing public attention. Wieser cautions that these consumer studies can show interviewer bias. GroupM has performed its own studies to more accurately capture people’s attitudes about advertising.

“If you left open-ended questions in the hands of consumers around advertising — whether or not they like it and want more of it — I think you’d find pretty uniformly the answer is ‘no,’” he said. “There are definitely exceptions where you have fantastic creative, where you have really endemic marketers whose products and brands are really aligned with what a consumer is doing within a niche hobby.”

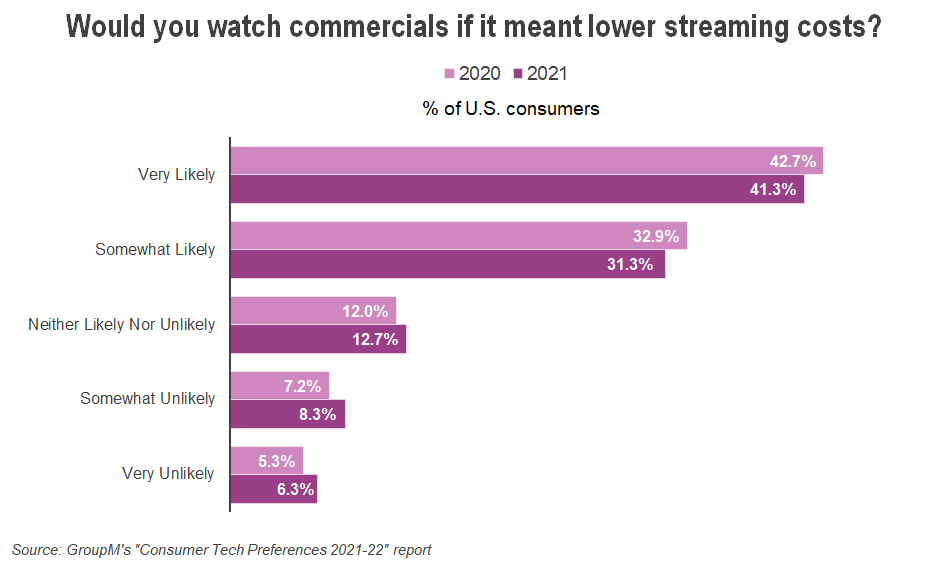

Fewer U.S. consumers than in the past said they will tolerate advertising if it means that can lower their streaming costs, according to GroupM’s tracking survey. The finding indicates that marketers and media outlets need to be mindful of ad loads.

“The tolerance for ad-supported streaming services is probably diminishing. It could very well be that just consumers are just tired of watching programming with 12 minutes an hour,” Wieser said. “You might find very different tolerances depending on again, how you frame the question, but also what the underlying offering is.”

You are watching “Engaging Stories, Impactful Innovation,” a Beet.TV Leadership Video Series presented by WarnerMedia. To view more videos from this series, please visit this page.