Up until now in the maturation of advanced TV ad targeting, many agencies and their clients had merely been dipping their toe in the water.

That is now changing, with more of them apparently seeing reason to flip their ad strategy on its head.

In this video interview with Beet.TV senior adviser Jon Watts, GroupM’s Executive Director, Specialty Channels, Jen Soch says there is more appetite to let advanced TV dominate media plans.

Foot-forward on addressable

“In the upfront, I heard an auto client speak to the fact that they really are looking at connected TV and household addressability as their main foot forward, and then they sprinkle in linear on the side,” Soch says.

“That got me giddy with excitement of what the possibilities are here. I definitely see some of our clients looking at that idea in the future. If you know your audience and if you know where you want to be, why not consider things a different way?

“Why not look at household addressability as a main foot forward? And when you combine our capabilities on what we can do on the set-top boxes and the MVPD players with what we can do in the overall connected TV landscape, I think we have a really good story as we move into 2021 and 2022.

“Now, you’ve just described a really interesting patchwork quilt of platforms and devices, each with their own slightly different capabilities and peculiarities. What are the big pain points that you and other agencies are grappling with at the moment?”

Music to advanced ears

The strategies Soch is hearing, as well as those she is contemplating for GroupM’s clients, bode well for a technology that promises capabilities like TV targeting, frequency-capping and performance attribution.

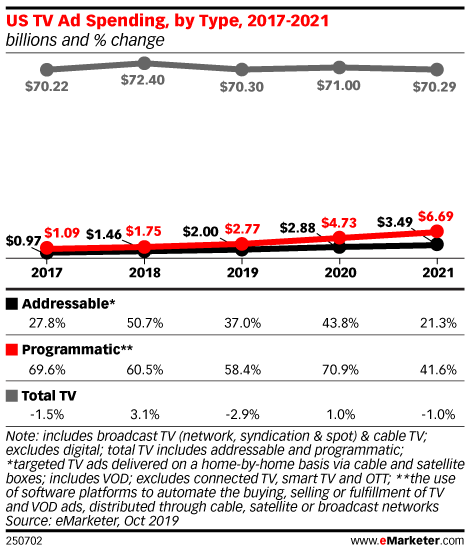

EMarketer previously estimated programmatic TV ad spending will reach $6.69 billion in the US by 2021, more than doubling from $2.77 billion.

That makes it a still-small but fast-growing part of the overall TV ad spending pie.

Sticking points

But the truth is that, for all its super-powers, buying addressable ad campaigns and truly benefitting from those capabilities, remains difficult for many buyers.

Buyer surveys and thought leadership research exercises tend to wind up reporting ad buyers as bemoaning the steps required to buy and measure across a proliferating range of services and screens.

“Measurement has always been our pain point,” GroupM’s Soch acknowledges. “We still haven’t quite gotten to that place where we can measure things as successfully as we’ve always wanted to measure them.

“We have had some success in some areas, but being able to truly layer in these individuals, be able to look at the overall reach, be able to account for frequency among these different platforms, that’s still going to be a pain point as we move into this upfront season.”

Personal feel

Soch also says historic discussion about creative versioning – the compulsion to assemble a custom ad for every viewer – hasn’t come to pass.

Instead, the agency has consolidated around a few key creative executions, and Soch says she is able to find deeper personalization in complementary podcast advertising.

She says: “We are having a lot of clients where we look at some great video plans and household addressability, and then we’re bringing in audio on the side with podcasts and other areas to supplement and even layer on an interesting platform on top of just the video for more of an addressable and personalised, customizable, creative look.”

You are watching “What’s Next For Advertisers? Key Changes That Will Drive The Industry Forward,” a Beet.TV leadership series presented by Comcast Technology Solutions. For more videos, please visit this page. For Comcast Technology Solutions’ paper on these topics, please visit this link.