A cool ticker symbol for a very exciting company: Innovid begins trading on the New York Stock Exchange as CTV. More public offering and pricing is in this release.

In June, when Innovid announced the SPAC< which enabled it to go public, I interviewed Zvika Netter, CEO. We have republished the video with today’s news.

Our earlier report:

Some revolutions happen very slowly – and then in a sudden crash of euphoria.

That is what seems to be happening with internet-connected T right now – and that’s what is happening for Innovid, too.

The ad delivery and measurement platform for connected TV has been working in the area for 14 years. Now, with the CTV waves crashing ashore, it is going public to raise $403 million in a deal valuing the business at $1.3 billion.

In this video interview with Beet.TV, Innovid co-founder and CEO Zvika Netter says the company’s vision never swerved, and he wanted to quickly capitalize on CTV’s COVID-era growth curve.

Visible vision

“(We aim to) support the growth of the company, (so that) our clients and our partners could see that and not think, ‘These guys raised all this money and they’re going to sell it to some big tech firm and move to Bora Bora’,” Netter says.

“We’re here to work and really change the future of television for many years to come.

“Now I think everybody will understand that this is we’re here to stay for a very long time and why it’s the right route for us.”

Deal structure

Innovid’s software automatically uploads and encodes advertising creative to stream ads to any screen or device, manages the physical delivery of ads and measures performance across the MRC-accredited metrics, connecting together a host of demand- and supply-side platforms, publisher apps and CTV devices.

It claims 40% of the top 200 US TV advertisers as customers.

According to The Wall Street Journal: “Innovid is planning to raise $403 million through a roughly $150 million private investment in public equity, or PIPE, at $10 per share, and $253 million from a special-purpose acquisition company (SPAC) called ION Acquisition Corp. 2.”

The company had taken a reported $95.1 million over eight funding rounds since 2008.

Going quickly public

After the earlier cooling-off in, ad-tech public listings are back in fashion after the pandemic revealed continued growth in key trends like online consumption and CTV ad capabilities.

PubMatic, Viant, AppLovin and DoubleVerify all recently went public, with Sprinklr and Integral Ad Science to follow.

“COVID was a delay – it’s a curse and a blessing in a way,” Innovid’s Netter says. “In Q2, we suffered like everybody else.

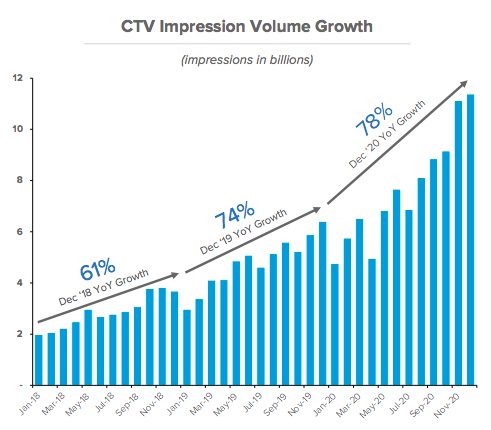

“But, very fast, we realised that the consumption of CTV, as everybody knows, is growing dramatically starting May and June of last year – and it’s never stopped.

“We waited for the presidential election to be over. We waited for the vaccines. We wanted to see that this is here to stay at scale. Once we saw it, we said, ‘Okay … we want to go and we want to go (public) very fast’.

“The SPAC allowed us speed. It was a way to lock this deal in a very high speed and be public, be out fast.”

CTV growth forecast

In May, eMarketer predicted 2021 US CTV ad spending would hit $13.4 billion.

The markets are realizing that linear TV consumption and classical pay-TV are unlikely to be resurrected, but that TV advertising generally remains effective.

So companies like Innovid are warming advertisers up to the idea they can deliver targeted, digital-style ads, with precision measurement, to TV-like devices. It’s a best-of-both-worlds strategy.

Innovid’s projections

Innovid wants a piece of an estimated $20 billion global CTV ad business, within a $200 billion global TV ad industry.

It projects its revenue growing from $69 million in 2020 to $177 million by 2023, 63% of it from CTV.

And Innovid boasts high customer retention, retaining 94% of core customers last year.

But it plans to double its operating expenses by 2023.

You are watching “Innovation, Leadership, and Value Creation: Strategies Explored,” a Beet.TV leadership series presented by Progress Partners. For more videos, please visit this page.