CANNES – Over-the-top (OTT) TV viewing is exploding. Now OTT operators need to see their advertising revenue increase at the same pace.

In this video interview with Beet.TV, Tariq Mahmoud, Roku head of international sales and strategy, describes a disconnect he expects will be closed in the next few years.

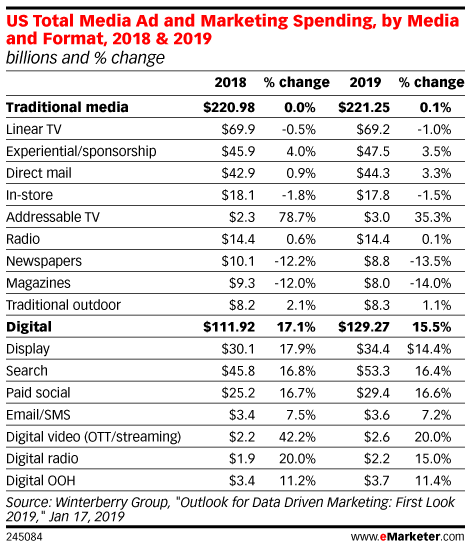

‘There’s this delta right now between OTT viewing and OTT ad spend,” Mahmoud says. “That will get closer and closer over time. Just like we saw in digital over the last five years, I think we’ll see that in TV as well. Ad spend on OTT … will catch up to viewership on OTT.”

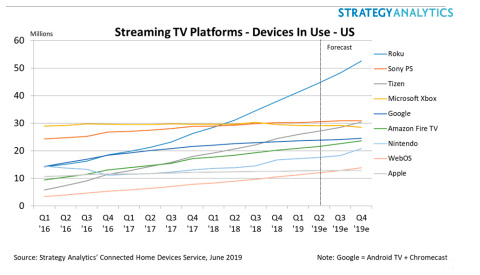

His comments come as just-published analysis by Strategy Analytics shows how Roku’s lead for connected TV device adoption is accelerating. More than 30% of the connected TV devices sold in the US in Q1 2019 were Roku devices, it says…

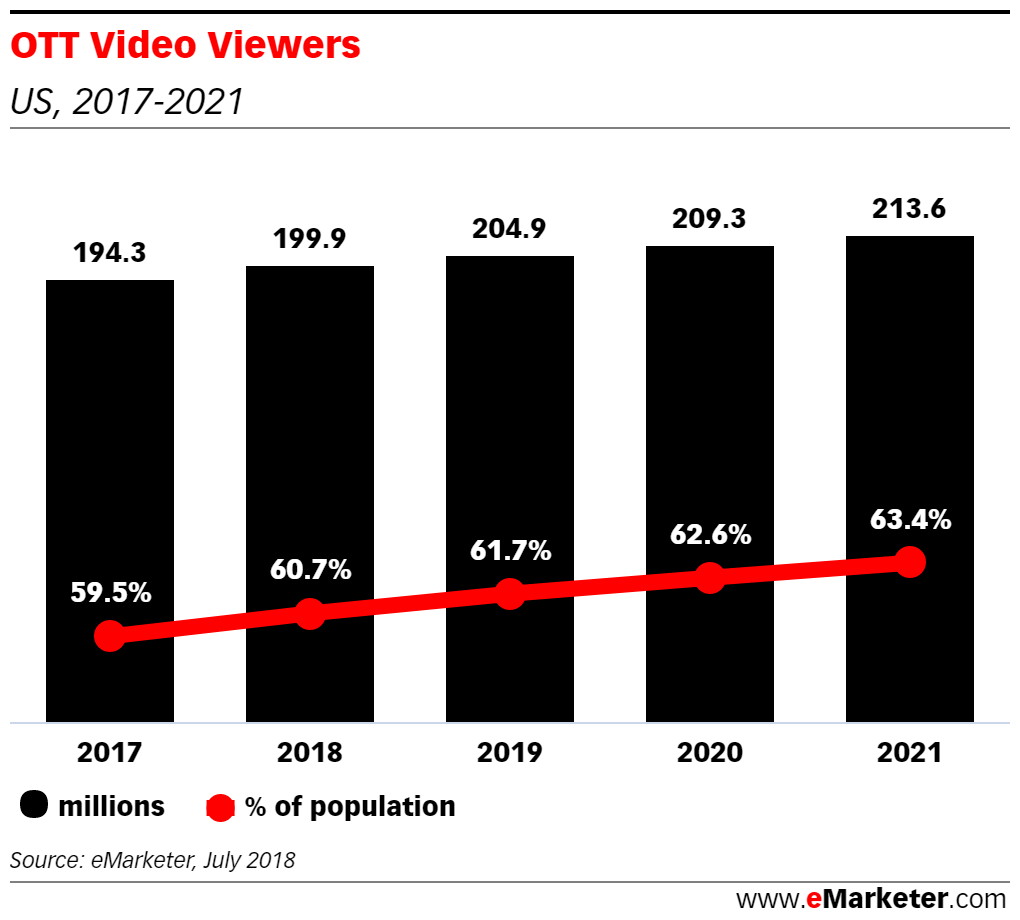

And the observation is interesting. eMarketer forecasts OTT viewing reaching another 1.7% of the US population by 2021…

But Winterberry Group sees US OTT advertising spend slowing, from 42% in 2018 to 20% in 2019…

That illustrates the need for OTT ad spending to catch up to OTT viewing.

Roku is well positioned. An attractive pricepoint, a simple proposition and integration in some TV sets is seeing Roku pull away from the rest of the pack, according to Strategy Analytics.

There are now more than 41 million Roku-based devices in use, including Roku media streamers and Roku-based smart TVs, accounting for 15.2% of all media streaming devices.

Roku now has a 36% lead over the next major platform, Sony PlayStation, in terms of devices in use. The report predicts that this lead will stretch to 70% by the end of the year, largely as a result of the success of Roku’s smart TV partner strategy.

Mahmoud says: “In Q1 of this year alone, we reached 29 million active accounts, which was 2 million more than the quarter before that, 9 billion hours of total hours streaming, relative to about 25 billion last year in total, 9 billion just of Q1, so our growth is tremendous.”

So, what is Roku doing to win advertising?

The outfit holds first-party data on its users in unique identifiers it calls RIDAs, helping facilitate targeted advertising. Earlier this year, Adobe Ad Cloud began matching marketers’ own audience segments to RIDAs, meaning buyers who use Adobe as a demand-side platform (DSP) can now end up buying Roku ads more easily.

Roku also offers 15- and 30-second video commercials but also background wallpaper sponsorships, sponsored content hubs or advertiser-funded free movie nights.

Twelve months ago, Roku launched a marketplace where TV networks can sell their ads to target specific audiences.

You can find all of Beet.TV’s coverage of Cannes on this page