LOS ANGELES – Despite historically being sold by manual insertion order, ad buyers are now flocking to the programmatic, or automated, sale of inventory.

That is according to major-network exec who says buyers are encouraged by technology that puts guide rails and control around the technology.

In this video interview with Beet.TV, Abbie Reichner, Programmatic Product Lead, Fox, describes the uptick – and says more assurances still need to be given.

Programmatic boom

“Last year, they really started to experiment and dip their toes into the programmatic space – that was mainly through the private marketplace,” Reichner says.

“This year, it’s really more apparent that programmatic is becoming a core part of the business and a key part of the strategy. In some cases, some of these major brands are really only executing through programmatic pipes.”

“This year, we’re seeing a tonne of requests for programmatic guaranteed. We’ve seen a significant increase in agencies and brands and buyers requesting for either executing their upfront commitments or a portion of their upfront commitments through programmatic guaranteed.

“It’s kind of switched our ad stack so that we have these sort of direct deals or deals that are similar to a direct IO, but they’re all going through the programmatic pipes.”

Spending growth

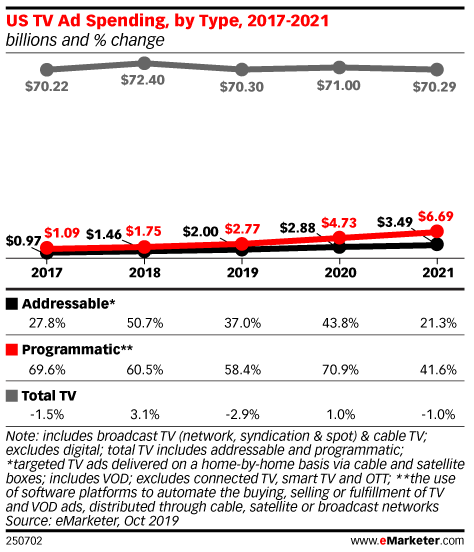

EMarketer in November estimated programmatic TV ad spending will reach $6.69 billion in the US by 2021, more than doubling from $2.77 billion.

That makes it a still-small but fast-growing part of the overall TV ad spending pie.

Ad buyers are getting interested by the ability to target specific audiences or households, the ability to use other data in doing so and the ability.

EMarketer also estimated CTV ad spending will reach $10.81 billion in the US in 2021 – up 56% from two years earlier, and representing around 15% of total US TV ad spending.

But Fox’s Reichner says more could be unlocked if some remaining challenges were tidied up.

Fighting fraud

She says ad fraud, which had plagued programmatic display ad sales, has also arrived in connected TV and video.

“I would love to say that the CTV space is 100% fraud free, it’s 100% viewable – but that really isn’t the case anymore,” Reichner says.

“We are seeing a rise in that fraudulent activity and CTV has become a larger target. So buyers are tasking us as a publisher to answer the question of ‘how do we combat this?’

“Our buyers are starting to demand transparency throughout the entire supply chain. So we’re doing that through working with our key partners, adopting new ad tools and through data pass-back.”

Taking steps

To that end, Fox was an early adopter of app-ads.txt, an equivalent of the IAB’s ads.txt standard that allows bona fide publishers to publish lists of the ad-tech platforms that are allowed to sell their inventory.

And Reichner says she is also “standardising bundle IDs”, meaning buyers and DSPs can more easily learn about ad impression effectiveness and identify fraudulent activity from spoofed apps.

But Reichner wants more.

“One thing that I would like the industry to move forward with is content object data,” she says.

That means metadata that describes the TV show, like rating, genre and episode descriptions.

Richer inventory data

“Not everyone is ready to send and receive that data within the bid stream,” Reichner acknowledges. “At Fox, we are able to – if you come to us, publisher-direct, we’re able to apply those show mixes and those DNA lists.

“We’re able to provide post-campaign, shell-level reporting, but all of that wouldn’t be necessary if we can start to include that data and that information in the bid stream.

“Buyers are asking for it. So we just need the standardisation and the technology to kind of catch up to where we need to be.”

You are watching “CTV Grows Up: Making a New Medium More Efficient & Effective,” a Beet.TV series presented by DoubleVerify. For more videos, please click here.